Buy Now Pay Later in 2026 no longer feels like a harmless convenience layered on top of shopping. What began as a simple way to split payments has matured into a structured credit product that behaves much more like a loan than many users realize. As adoption has widened, rules have tightened, reporting has improved, and consequences have become clearer for anyone who treats BNPL casually.

The biggest shift in 2026 is awareness. Users are starting to understand that BNPL is not “free money” or a neutral payment option. It is short-term credit with real impact on credit history, repayment behavior, and future borrowing ability. Understanding how BNPL works today is essential to using it safely rather than accidentally damaging financial health.

Why BNPL Feels Different in 2026

Earlier BNPL models focused on frictionless onboarding. Minimal checks, instant approvals, and low visibility of consequences drove rapid adoption. In 2026, that phase has ended.

Platforms now emphasize clearer disclosures, repayment schedules, and eligibility checks. This change reflects growing concern over overuse, defaults, and consumer misunderstanding.

BNPL in 2026 feels more serious because it is treated more seriously by lenders, regulators, and credit systems.

How BNPL Actually Works Behind the Scenes

BNPL splits a purchase into scheduled repayments, usually over weeks or months. While it feels like deferred payment, it is technically a form of credit extended by the provider.

Providers pay merchants upfront and collect repayments from users over time. This means the provider carries risk and therefore tracks repayment behavior closely.

In 2026, BNPL providers increasingly integrate with broader credit systems, linking usage to financial profiles more directly than before.

Hidden Charges Many Users Still Miss

One reason BNPL gained popularity was the promise of zero interest. While interest may not apply in all cases, other costs can appear.

Late payment fees, processing charges, and penalties accumulate quickly when schedules are missed. Some platforms also impose charges for rescheduling payments.

In 2026, BNPL is affordable only when used exactly as intended. Deviations often come with costs that surprise users later.

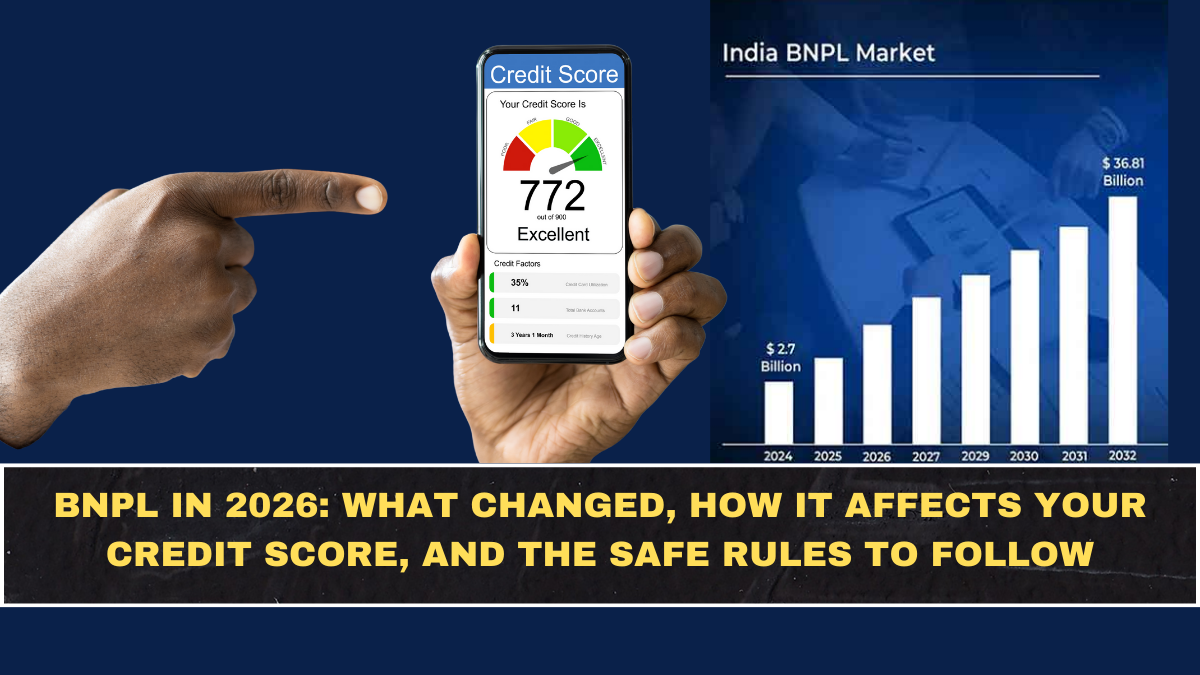

How BNPL Affects Your Credit Score Now

A major change in 2026 is visibility. BNPL usage is no longer isolated from credit reporting in many cases.

On-time repayments can support credit history, but missed payments damage it. Frequent BNPL usage may also signal dependency on short-term credit.

Users who treat BNPL casually risk long-term consequences that extend far beyond a single purchase.

Why BNPL Can Quietly Encourage Overspending

BNPL reduces the psychological barrier of payment. Smaller installments feel easier than one-time payments, encouraging larger or more frequent purchases.

This effect compounds when multiple BNPL plans overlap. Users may lose track of total obligations until repayments strain monthly budgets.

In 2026, the danger of BNPL lies not in one transaction, but in accumulation.

Who Should Be Extra Careful Using BNPL

Users with irregular income, tight monthly budgets, or existing debt should approach BNPL cautiously. Missed payments hurt most when finances are already stretched.

Young users and first-time credit users are also vulnerable because they may not fully understand credit mechanics.

BNPL works best for disciplined users who track obligations carefully.

Safe Rules for Using BNPL in 2026

Limit active BNPL plans. Fewer commitments reduce risk of missed payments.

Always treat BNPL as debt, not delay. If you cannot afford the full amount today, reconsider the purchase.

Track repayment dates manually rather than relying on app reminders alone. Responsibility reduces surprises.

When BNPL Makes Sense

BNPL can be useful for predictable expenses, short-term cash flow management, or smoothing payments without interest.

Used occasionally and intentionally, it offers flexibility without long-term harm.

In 2026, BNPL is a tool, not a lifestyle.

When BNPL Becomes Dangerous

BNPL becomes risky when it replaces budgeting, encourages impulse buying, or masks financial stress.

Using BNPL to fund non-essential spending regularly is a warning sign.

Recognizing this boundary is critical to avoiding credit damage.

How BNPL Providers Are Changing Behavior

Providers now emphasize education, limits, and responsible usage messaging. This reflects recognition that long-term sustainability depends on healthier user behavior.

Stricter checks may feel inconvenient, but they reduce defaults and protect users.

In 2026, BNPL is moving closer to traditional credit norms, whether users notice or not.

Conclusion: BNPL Rewards Discipline, Not Convenience

BNPL in 2026 is no longer a harmless shortcut. It is structured credit with real consequences for misuse.

Users who approach BNPL with discipline, awareness, and restraint can benefit without damage. Those who treat it casually risk long-term financial strain.

The smartest BNPL strategy is simple: use it sparingly, track it carefully, and never forget it is credit.

FAQs

Is BNPL considered a loan in 2026?

Yes, BNPL functions as short-term credit and is increasingly treated like a loan.

Does BNPL affect credit scores now?

Yes, on-time or missed repayments can influence credit history depending on provider integration.

Are there hidden fees in BNPL?

Late fees and penalties can apply if repayment schedules are not followed.

Is BNPL safe to use regularly?

Regular use increases risk. BNPL works best when used occasionally and intentionally.

Who should avoid BNPL altogether?

Users with unstable income or existing debt should be cautious or avoid BNPL.

What is the safest way to use BNPL?

Limit plans, track repayments manually, and treat BNPL as real debt, not free money.